Regenerative Medicine Market 2024

The global regenerative medicine market size was valued at USD 55.03 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 15.7% from 2023 to 2030. Several advancements in biological therapies have shifted the preference toward personalized medicinal strategies over traditional treatment methods. This has created significant opportunities for market players who are involved in biological therapeutics development.

Once reserved for the world's pro athletes and billionaires, the global Stem Cell Therapy market size was exhibited at USD 12.9 billion in 2022 and is projected to hit around USD 46.74 billion by 2032, growing at a CAGR of 13.74% during the forecast period 2023 to 2032. (R)

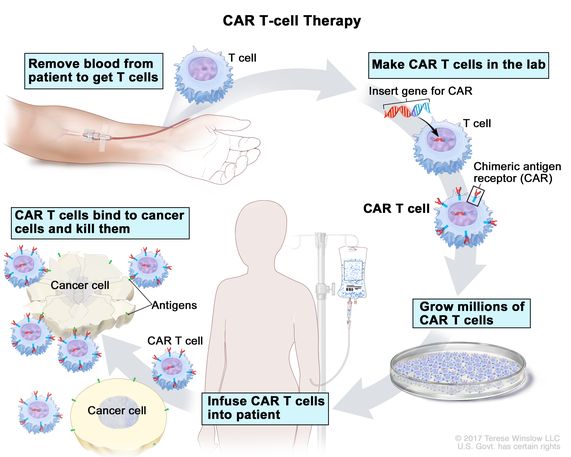

The global T-Cell therapy market was valued at USD 2.83 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 35.33% from 2023 to 2030 (R).

The COVID-19 outbreak has considerably impacted various markets, including the regenerative medicine and T-cell therapy manufacturing market. The SARS-CoV-2 coronavirus crisis has significantly affected the delivery of CAR T-cell therapies.

This impact is not just limited to patient care but has extended to administration, logistics, and limited healthcare resources. Several universities have slowed down clinical trial enrollment and other research activities.

Furthermore, regenerative medicines have been identified to have the unique ability to alter the fundamental mechanisms of diseases. Regenerative therapies in trials provide promising solutions for specific chronic indications with unmet medical needs. In December 2021, Novartis announced the introduction of T-Charge™, a next-generation CAR-T platform that would be a beneficial tool for novel investigational CAR-T cell therapies.

Significant advancements in molecular medicines have resulted in the development of gene-based therapy, which uses targeted delivery of DNA as a medicine to fight against various disorders. Gene therapy has high potential in the treatment of cancer and diabetes type 1 & 2 through restoring gene function.

The global gene therapy market size was estimated at USD 8.67 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 19.5% from 2024 to 2030. (R)

However, the market continues to expand as market players such as Novartis provide access to therapies such as Athersys, Inc.’s MultiStem, which is a highly relevant COVID-19 therapy.

Significant advancements in molecular medicines have resulted in the development of gene-based therapy, which uses targeted delivery of DNA as a medicine to fight against various disorders. Gene therapy has high potential in the treatment of cancer and diabetes type 1 & 2 through restoring gene function.

Currently, gene-based therapies are used in the treatment of patients suffering from cancer, oncology, infectious diseases, cardiovascular disorders, monogenic diseases, genetic disorders, ophthalmological indications, and diseases of the central nervous system. These factors have contributed to the growth of the regenerative medicine market.

Related: Gendicine (Ad-p53), The First Approved Gene Therapy Product for Cancer

The banks segment is projected to witness considerable growth in the coming years. Considerable investment has been made to establish bio-banks, including tissue and cord blood banks, to provide the perceived research benefits. These banks comprise systematically organized and maintained cell lines for single or multi-use by researchers, healthcare providers, and other stakeholders. Stem cells and biologically engineered tissues are the most significant tools used in regenerative medicine. Thus, these banks are an important part of the regenerative medicine market.

The cardiovascular segment is anticipated to witness significant growth during the forecast period. Advancements in cell-based therapies and regenerative medicines have accelerated the growth of the segment. Many key players are involved in the development of regenerative therapies to repair, restore, and revascularize damaged heart tissues. There is a growing adoption of single and mixed cells from autologous as well as allogeneic sources to study the effect on CVDs. In addition, advanced biologics, small molecules, and gene therapy are being investigated to stimulate the regeneration of damaged heart cells. These factors would further fuel the regenerative medicine market growth.

Product Insights

The therapeutics segment held a 69.1% revenue share of the regenerative medicine market in 2022, owing to the rising geriatric population, coupled with higher incidence rates of age-related as well as degenerative disorders. The increased prevalence of diseases with unmet medical solutions, such as cancer, diabetes, and neurodegenerative diseases, including AMD, has encouraged researchers to develop alternative options. For instance, in April 2022, Kite, a Gilead Company, announced that it had received the U.S. FDA's authorization for its CAR T-cell therapy product, Yescarta, which could be used for the treatment of refractory or relapsed large B-cell lymphoma.The banks segment is projected to witness considerable growth in the coming years. Considerable investment has been made to establish bio-banks, including tissue and cord blood banks, to provide the perceived research benefits. These banks comprise systematically organized and maintained cell lines for single or multi-use by researchers, healthcare providers, and other stakeholders. Stem cells and biologically engineered tissues are the most significant tools used in regenerative medicine. Thus, these banks are an important part of the regenerative medicine market.

Therapeutic category Insights

The oncology segment dominated the regenerative medicine market in 2022, capturing a revenue share of 32.3%, owing to the growing burden of cancer globally. Various government organizations along with private companies have made high investments in cancer research and the development of regenerative & advanced cell therapies. In January 2023, Calidi Biotherapeutics (CBT) and First Light Acquisition Group (FLAG) entered into a partnership agreement that aims to revolutionize oncolytic virotherapies with the help of stem cell-based platforms.The cardiovascular segment is anticipated to witness significant growth during the forecast period. Advancements in cell-based therapies and regenerative medicines have accelerated the growth of the segment. Many key players are involved in the development of regenerative therapies to repair, restore, and revascularize damaged heart tissues. There is a growing adoption of single and mixed cells from autologous as well as allogeneic sources to study the effect on CVDs. In addition, advanced biologics, small molecules, and gene therapy are being investigated to stimulate the regeneration of damaged heart cells. These factors would further fuel the regenerative medicine market growth.

Comments

Post a Comment